Jessica Morden Jessica Morden - Labour MP for Newport East, PPS to Keir Starmer and Shadow Minister for Wales

The pressures of the rising cost of living are impacting each household right now, but – there is help out there. Previously I have shared information about help for home energy, but with the new Council Tax year about to start, I thought I’d share some information on Council Tax support that you might be entitled to.

If you live in Newport, here’s the information you need.

Single person discount

This applies where only one adult lives in a household -this discount totals 25%.

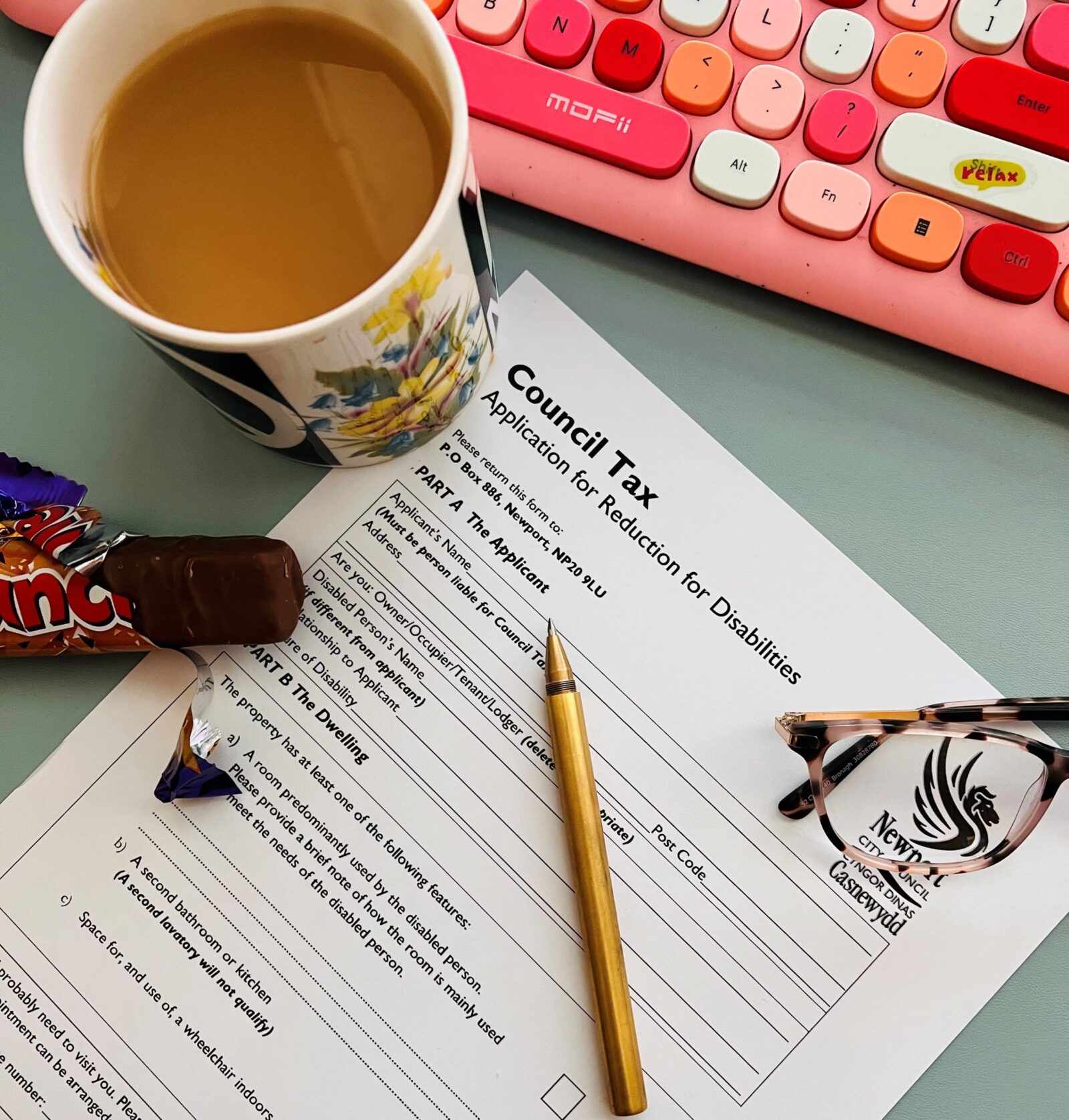

Disabilities reduction

Council tax may be reduced if a permanently disabled person (adult or child) lives in a dwelling which has certain features which are essential or important to the disabled person such as:

- room other than a bathroom, kitchen or toilet, used mainly by the disabled person

- additional bathroom or kitchen for the use of the disabled person

- space inside the dwelling for use of a wheelchair

The council has to decide whether the person with the disability would find it impossible or extremely difficult to live in the dwelling, or whether their health would suffer, or the disability become more severe, if the extra feature were not available

If your home is eligible, your bill will be reduced to that of a property in the valuation band immediately below the band shown on the valuation list.

Other reductions

There are a whole host of circumstances in which Council Tax discount may also be applied – here are a few:

People with severe mental impairment

If a person has a severe mental impairment, including mental health problems or dementia, a discount may be applicable.

The person must be certified by a registered medical practitioner and entitled to receive of one of the following benefits:

- Attendance allowance

- Severe disablement allowance

- The care component of a disability living allowance payable either at the highest rate or the middle rate

- An increase in the rate of disablement pension

- Disability working allowance

- Unemployability supplement

- Income support which includes a disability premium

- Incapacity benefit

- Employment support allowance

- the daily living component of a personal independence payment

- universal credit which is an amount paid to a person where there is a limited capability for work or limited capability for work and work-related activity

Students in full-time education

A certificate of student status is required, contact the registrar at the educational establishment.

Students and their dependants may also qualify if they are not UK citizens and cannot claim benefits or take paid employment.

School and college leavers

18 and 19 year olds who have just left school or college are disregarded until 1st November of that year.

Student nurse

A certificate of student status is required, contact the registrar at the educational establishment.

Residents in a care home, hospital or hostel

This relates to people whose main residence in a residential care home, nursing home, mental nursing home or hostel and who are receiving care and/or treatment there.

Carers/Caseworkers

Care workers employed by a charity or local authority to provide care, support or both to a person, may receive a 25% discount off the council tax bill provided certain conditions are met:

- Support is provided for at least 24 hours per week

- Weekly salary must not exceed £36

- The careworker must be resident on the premises provided by the charity or local authority

- The property is not already occupied by two or more persons that do not qualify for any reduction

Carers must be unpaid and resident in the same dwelling as the person cared for, who must be not be the carer’s partner or child under the age of 18. Care must be provided for at least 35 hours per week on average. The person cared for must be in receipt of one of the following benefits

- attendance allowance (at any rate)

- the highest or middle rate of the care component of a disability living allowance

- increased disablement pension

- increased constant attendance allowance

- the standard or enhanced rate of the daily living component of a personal independence payment

Apprenticeships

A person who is employed to learn a trade or profession and who is in receipt of training that will lead to a qualification.

The person must earn less than £195 per week.

Find out more about all of these here

Living in Monmouthshire?

Similar discount structures apply – to apply call 01633 644630 or email: counciltax@monmouthshire.gov.uk